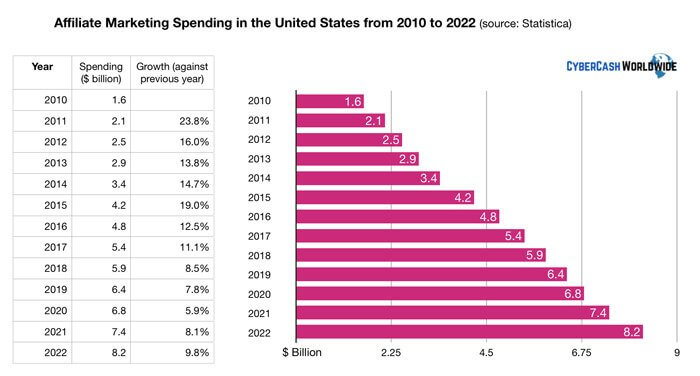

Affiliate marketing is more popular than ever. And it’s easy to see why; it’s a convenient way for both independent marketers and the businesses they promote to boost their finances. Many affiliates do this as a side hustle alongside a regular job—so how does that work in terms of taxes?

In this post, we’ll dive into the world of affiliate marketing taxes and see how they apply in different countries, including the US and UK.

Is affiliate marketing taxable?

First things first: you do need to pay taxes if you do affiliate marketing. But how much tax you pay, and the way it’s collected, depends on where you live and work.

When you receive payment from a selling company or affiliate program owner, no tax has been deducted yet, so you’ll have to file a tax return and pay what you owe later.

While many affiliates are self-employed, you can choose to set up a company.

In the US, this could be either a Limited Liability Company (LLC), a C corporation, or an S corporation. In the UK, you can choose to register as self-employed with HMRC (HM Revenue & Customs), or as a Limited Company with Companies House.

If you’re an affiliate marketer in the US, you’re not liable for sales taxes because you’re not actually selling anything—you’re just referring customers to the seller. That said, you’ll still have to pay state income taxes and self-employment taxes.

The amount you pay will depend on how much you earn. In the UK, you can earn up to £1,000 in one tax year without having to declare it to HMRC. In the US, if your income is more than $600 per month, the IRS (Internal Revenue Service) requires you to make estimated quarterly tax payments.

And btw, if you’re looking for some new affiliate programs to join, check out some recommended programs here.

How to track affiliate marketing taxes

You need to keep track of your affiliate earnings for each tax year so that you can calculate how much tax you’ll need to pay—minus any allowable expenses.

If the idea of crunching those numbers sounds scary, don’t worry. There is software out there that can help you. You might be using a tracking tool for your affiliate sales, but specific software for self assessment will make life easier.

Let’s talk about gross income for a minute. Your gross income is the total amount you make from affiliate marketing, while net income is gross income minus expenses.

When filing taxes related to affiliate marketing income, you need to deduct all expenses from your gross earnings to determine taxable income.

Remember that expenses are only those costs directly related to affiliate marketing activities such as web hosting, software subscription, and utility bills. You can’t deduct personal expenses, like a spa day or your Netflix subscription.

7 affiliate marketing tax tips for 2025

There’s a lot to consider when it comes to affiliate marketing taxes—here are some tips for getting it right:

1. Learn about affiliate nexus law

You may be aware of the sales nexus law in the US, which stipulates that if you have a connection with a state, you’re required to pay sales tax when you meet a certain threshold. This applies in all but 4 states.

Since 2008, an affiliate nexus law has been in operation—imposed when an out-of-state business has a connection via an affiliate marketer located within the state. This enables tax collection, even if the seller of the goods is not physically present in the state where the goods are sold.

2. Understand your tax obligations and stay updated

Taxation can be tricky, but it’s important to take the time to get to know the latest laws surrounding affiliate marketing taxes.

If you’re not sure of your obligations, you could end up underpaying or overpaying tax–not ideal.

As we mentioned earlier, affiliate marketing tax obligations vary between sole traders and limited companies, between countries, and between states. Remember that the laws might have changed since you last checked, so make sure you’re keeping your fingers on the pulse there.

3. Start with Making Tax Digital

If you’re based in the UK and filing with HMRC, the government has introduced a new initiative called Making Tax Digital (MTD), aimed at simplifying the way in which sole traders and small businesses report their earnings.

From April 2026, anyone registered for self-assessment must keep digitized records, as well as having MTD-compliant software. The idea is to speed up the taxation process and help users to maintain accurate records.

4. Modernize software and programs used to track affiliate income

No matter whether you’re working alone or as part of an affiliate program, you need to be highly-organized when it comes to managing your income and taxes.

Keeping basic records of your affiliate earnings isn’t going to cut it as you join new affiliate programs. And if you’re already using software to track your commissions, you may need an upgrade as you grow.

Investing in software that can create and send invoices will help you stay organized and track what you’re owed. Accounting software like that provided by Sage can help you do this. It can also calculate and submit tax to make sure you’re always compliant with regulations in your area.

Other factors to consider are multi-currency banking and invoicing if you choose to branch out into international markets, advanced reporting and cash flow forecasts if you’re actively looking to grow your business, or upgrades that allow for unlimited users if you plan on expanding your team.

5. Leverage tax deductions

Tax deductions, also known as allowable expenses, help you to reduce your amount of taxable income. Work out your earnings and then deduct the following costs:

Software subscriptions

Great news. The cost of the software you use for affiliate marketing—content creation, social media management, and tracking commissions—is an allowable expense.

If you bought a laptop or tablet purely for this work, you can deduct the cost, along with hosting fees for your website or blog.

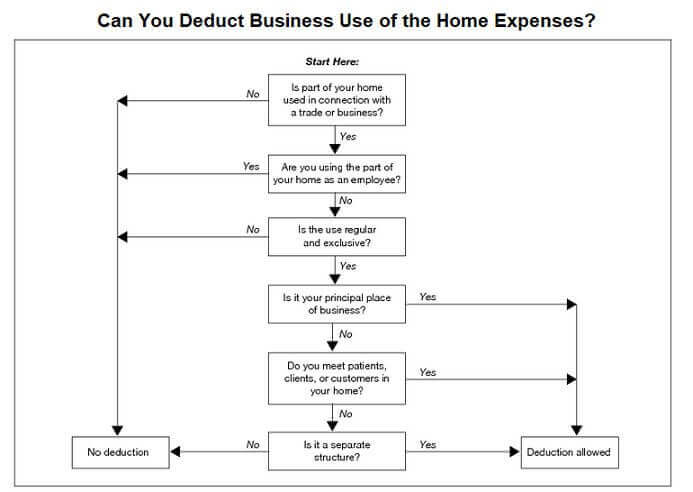

Utilities for remote affiliate marketers

If you work remotely, you’re eligible for a home office deduction. This includes things like heating and electricity, but you can only claim for the percentage used during your hours of work.

Labor costs

If you have people working for you, and you’re paying them a wage, you can also put this down as a business expense.

Phone bill

You’ll be using the phone and the internet to keep in touch with clients and partners and promote their products, so you can claim a percentage of those bills. This includes your cell phone, if you use it for work.

6. Keep accurate records of your expenses, income, and receipts

Maintaining accurate records is necessary for the smooth running of your affiliate marketing business, but it also makes life a lot easier when sorting out your taxes.

Hold on to the records for at least three years, in case you need proof of your earnings or get audited. It’s good practice to keep a separate bank account for affiliate income and expenditure. You can also make use of project management software for accountants to help you keep your records organized.

Affiliate marketing tax laws across the world

Affiliate marketing taxes vary widely between countries, and it’s important to know which laws apply to you. The following section outlines some of them.

Affiliate taxes in the United States

As we mentioned earlier, US-based affiliates have the option of forming an LLC. If it’s a single-member company, you’re taxed in the same way as a sole proprietorship and must fill out a W-9 form for each client.

For multiple-member LLCs, you have to file an informational return (Form 1065) with the IRS, while for C Corps, it’s Form 1120.

Affiliate taxes in the United Kingdom

In the UK, those registered for self-assessment must file a tax return (Form SA100) online by 31 January each year.

As an affiliate marketer, you’ll need to pay self-employment taxes (income tax, plus Class 2 and Class 4 National Insurance) on your taxable business profits.

You’ll be happy to know that the tax-free personal allowance means you’re not taxed on the first £12,570 of your earnings.

Once your business’ taxable turnover exceeds £85,000, you’re legally required to register for VAT. This means more admin, but can bring tax and cash flow benefits—and filing tax returns will become simpler with HMRC’s plans for Making Tax Digital.

Affiliate taxes in the European Union

The EU has specific rules for selling any kind of digital product, under the MOSS (Mini One Stop Shop) legislation for VAT payments.

You don’t have to claim affiliate marketing taxes in your own country—just submit a quarterly MOSS report for VAT, detailing all the sales you make across different EU countries.

Affiliate taxes in India

In India, affiliate income is assessed via PGBP (Profit and Gain from Business & Profession), which allows you to claim related expenditure as a business expense. If your estimated tax liability for the year is Rs.10,000/- or more, you’ll be taxed in advance on next year’s expected profits. If your commission income exceeds Rs. 1 crore in a year, it must be audited by a chartered accountant.

Final thoughts

Affiliate marketing can be a highly lucrative practice, whether it’s a side hustle or a full-time career. But as you start to earn money, be aware that you do have to pay tax on your income—just like any other business.

If you familiarize yourself with the applicable laws in your country or state, and maintain accurate records, you’ll avoid any mix-ups or fines.

You may also like:

- Gain extra revenue streams with the affiliate program

- Affiliate Marketing 101: How to Get Paid

- Affiliate Marketing Myths (and the real truth behind them)

- Best Affiliate Marketing Examples to Help You Make Money While Sleeping

- Best Affiliate Programs

- How to Promote Affiliate Links

- 15 Types of Affiliate Marketing Content to Promote Products (tips included)

- Why Do You Need an Affiliate Marketing Funnel, and How to Build One

- 15 Best Affiliate Marketing Tools

- All You Need to Know About TikTok Affiliate Marketing

- How to Plan Your TikTok Affiliate Marketing Strategy Around Black Friday and The Holiday Season